what is fit on a pay stub

What is fit payroll. FIT is the amount required by law for employers to withhold from wages to pay taxes.

Solved Federal Taxes Not Deducted Correctly

FIT tax is calculated based on an employees Form W-4.

. Employers withhold FIT using either a percentage method bracket method or alternative method. For example if an. Fit stands for Federal Income Tax Withheld.

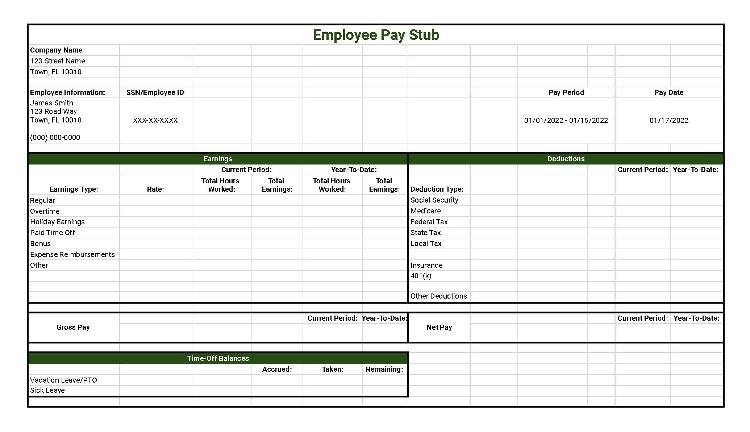

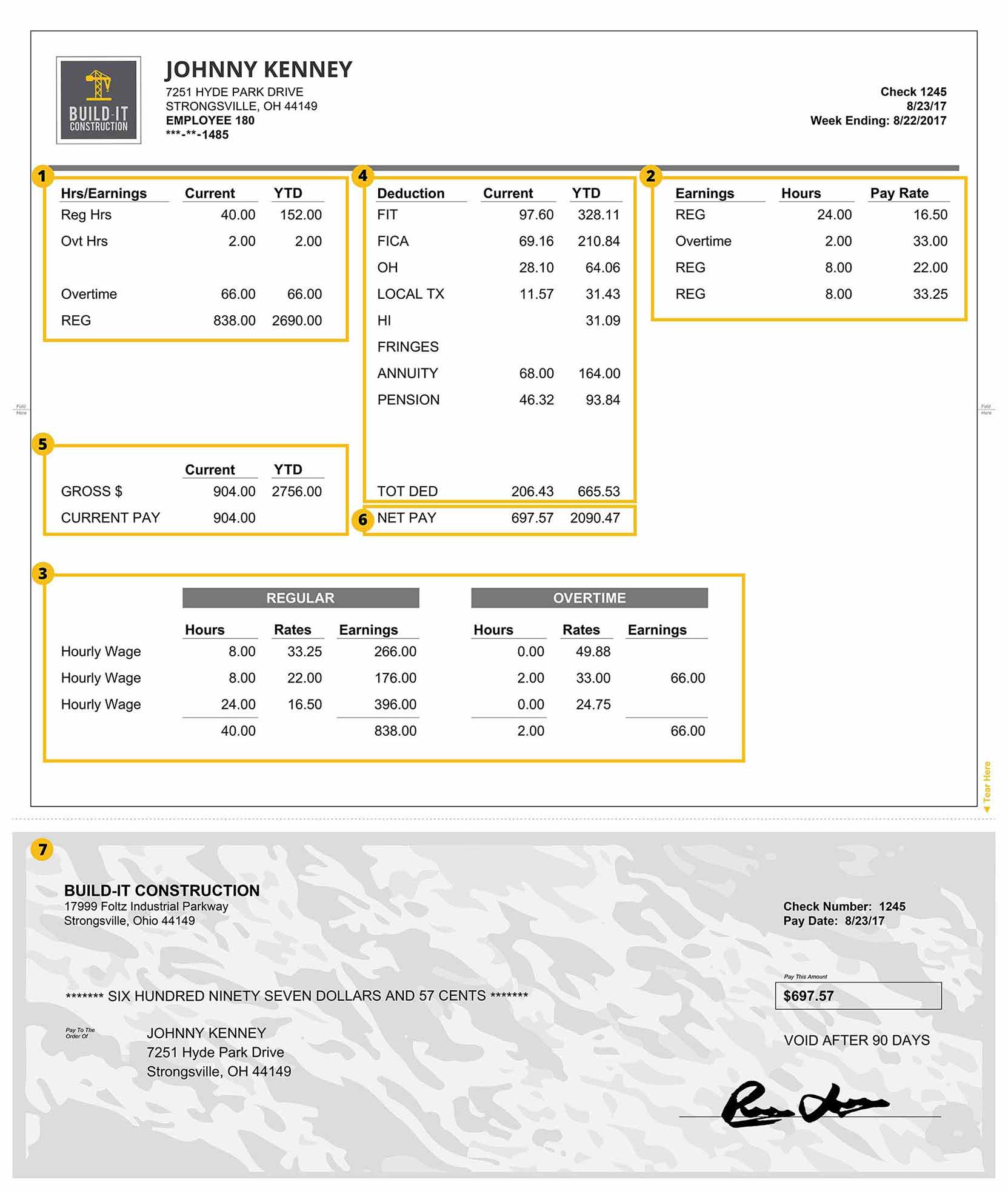

Pay Stub Abbreviations are the abbreviations that you come across on any pay stub. These items go on your income tax return as payments against your income tax liability. It shows them all the deductions that resulted in the net pay that shows up on the paychecks.

In the United States federal income tax is determined by the Internal Revenue Service. A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid. Where your pay goes before you get to take it home.

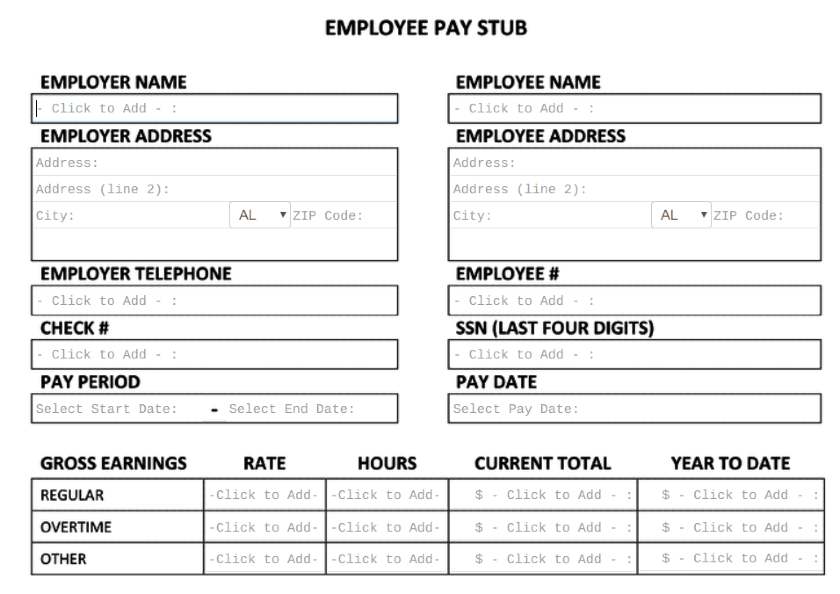

Our check stub maker gives you its free online paystub calculator tool through which you can carry out all calculations regarding salaries for both hourly paid and. A pay stub may be created as a separate part of a paper paycheck or it may exist in electronic form. This amount is based on information provided on the employees W-4.

FIT stands for federal income tax. Withholding is one way of paying. If your employee has.

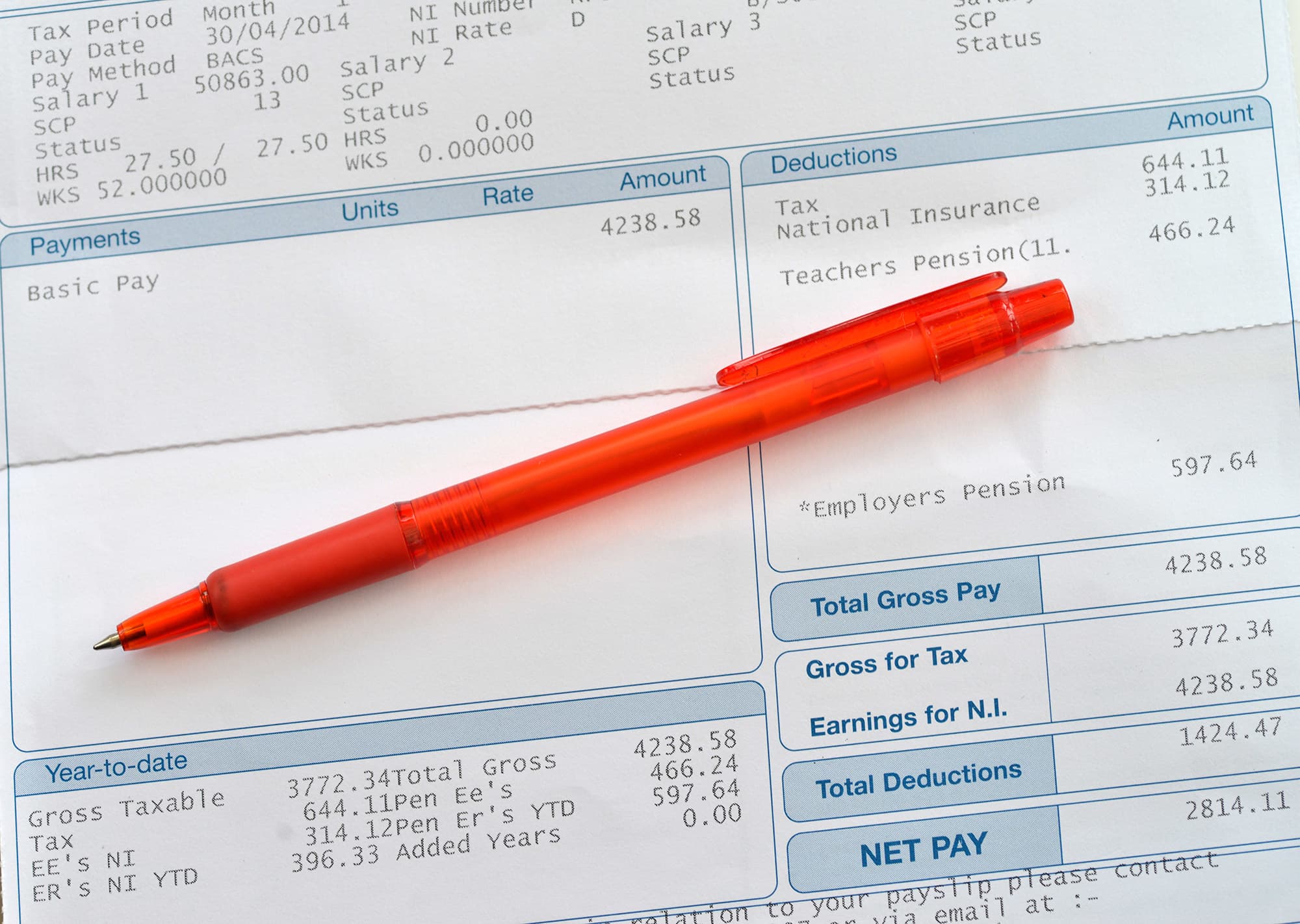

FIT deductions are typically one of the largest deductions on an earnings statement. Pay stubs are documents that showcase your earnings at any given period and are used to serve as a tracking document for employers and their employees to monitor working hours and. FIT tax refers to Federal Income Tax.

A pay stub is given to employees along with their paychecks. A pay stub is a document that outlines payroll information about a particular employee for a certain pay period. Fit is applied to taxpayers for all of their taxable income during the year.

Some are income tax withholding. The employer and the employee both pay 62 percent of gross compensation for the Social Security portion of the FICA on a paystub totalling 124 percent. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it. A pay stub can also be known as a. A paycheck stub breaks down your employees gross wages.

The stub is something the employee can use to confirm what funds were withheld from the gross pay that. FIT is applied to taxpayers for all of their taxable income. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

FIT Fed Income Tax SIT State Income Tax. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their. Your net income gets calculated.

FIT is the amount required by law for.

Understanding Your Paycheck Credit Com

Pay Stub Generator With Database Pay Slip Creator For Hourly Etsy

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

What Information Is Included On A Paystub Inscmagazine

Be Sure To Check Your Pay Stubs Total Food Service

Free Pay Stub Templates Tips Laws On What To Include

What Is The Fit Deduction On My Paycheck

/cdn.vox-cdn.com/uploads/chorus_asset/file/3722016/TyrGObW.0.jpg)

Andrew Mccutchen S Pay Stub Includes Lots And Lots Of Taxes Sbnation Com

Free Pay Stub Templates Tips Laws On What To Include

Online Pay Stub Generator 7 Best Options For Your Business

How To Decipher Those Strange Codes On Your Paycheck

A Construction Pay Stub Explained Payroll4construction Com

What Is A Pay Stub 5 Reasons Why They Are Crucial To Your Small Business

Ukg Dimensions Payroll Product Profile Ukg

What Is A Pay Stub What To Include On An Employee Pay Stub

Compliance Support Fake Pay Stubs Are Mucking Up Income Verifications Part 1